Before vs. After: How FY25’s Policy & Funding Tweaks Shifted Pakistan’s IT Export Momentum

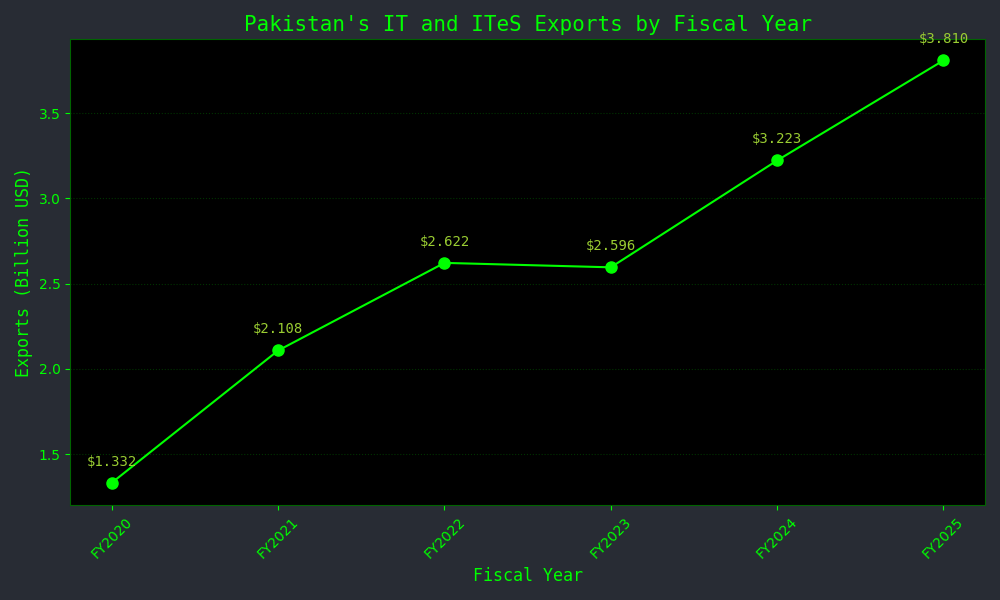

The narrative around Pakistan’s IT exports shifted in FY25. After several years of mixed performance, the sector reported encouraging numbers: IT & ITeS exports reached around $3.8 billion in FY2024–25, and Q1 of FY2025–26 alone recorded about $1.057 billion (up ~20.5% YoY). These headline figures prompt a question: did FY25’s funding and policy changes materially move the needle — or are we seeing coincidence rather than causation?

This article examines the evidence: what changed in FY25 (public funding, forex rules, and institutional initiatives), how those changes might plausibly affect exporters, and where the data are still thin. I aim to be clear about which claims are supported by hard numbers and where the argument remains tentative.

(Sources referenced throughout: State Bank of Pakistan reports, Profit (Pakistan Today), Business Recorder, Dawn, Tribune, ProPakistani, PSEB announcements.)

Before FY25: constraints and dampened momentum

Leading up to FY25, Pakistan’s IT exports were hampered by several structural constraints:

- Tighter foreign currency retention rules that limited exporters’ ability to hold and reinvest dollars domestically (previous retention limits were lower than the revised FY25 rule).

- Limited public infrastructure investment specifically earmarked for export‑oriented tech clusters (previous PSDP allocations were modest).

- Startup funding contraction in 2023–24, which reduced private capital available to scale export‑oriented firms.

Despite strong human capital and a growing freelance base, these headwinds made it harder for exporters to scale, invest in overseas sales efforts, or absorb short‑term shocks.

FY25: policy and funding moves worth noting

Several concrete changes and announcements in FY25 are relevant when assessing the policy environment for IT exporters.

1) Forex retention and export friendly banking adjustments

The State Bank of Pakistan (SBP) revised rules that allowed exporters to retain a larger share of foreign earnings in special accounts. Reports indicated this retention level increased to around 50%, giving export firms and freelancers more flexibility to hold and use foreign currency without immediate conversion to PKR. This eases working capital constraints for firms servicing foreign clients and reduces currency‑conversion friction for freelancers.

2) Budgetary & PSDP allocations targeting IT projects

Publicly reported allocations show mixed signals: headline federal allocations to IT in prior budgets were around Rs 79 billion, whereas some PSDP figures for new IT projects in FY25–26 were reported near Rs 13.5 billion for project work. Separately, the Special Technology Zones Authority (STZA) announced infrastructure investment plans (reported about Rs 30 billion across new STZs). These moves indicate renewed government willingness to invest in digital infrastructure — physical zones, connectivity, and incubation space — that can support export growth.

3) Institutional supports & export facilitation

Agencies like the Pakistan Software Export Board (PSEB) and new instruments such as Exporters’ Innovation Accounts (EIAs) and special facilitation for registered IT exporters signalled a more export‑friendly direction. Trade promotion, participation in international expos, and targeted training schemes also featured more prominently in FY25 activity.

4) Public signalling and soft incentives

Industry lobbying bodies (P@SHA and others) pushed for clearer tax treatments and longer term tax relief. While full tax exemptions were not universally granted, public dialogue and some temporary reliefs improved sentiment among exporters.

The early results: exports accelerate — correlation, not proof

The clearest hard result is the export number itself: $3.8 billion in FY24–25 and $1.057 billion in Q1 FY25–26 (20.5% YoY growth). In narrative terms, FY25 looks like a turning point. But to be rigorous, we must separate three things:

- Timing: Do policy moves precede the export uptick? Mostly yes — some forex and incentive adjustments were introduced or announced in early FY25.

- Mechanism: Would retention rules and infrastructure investments plausibly raise exports? Yes — they reduce working‑capital friction and build capacity.

- Magnitude: Are the observed policy changes large enough to explain the full export increase? That’s less certain — private investment, freelance earnings, and global demand shifts also play roles.

In short: the timing and mechanisms support a plausible causal story, but the available public data do not conclusively prove causation.

Missing pieces: what we still need to verify

To make a watertight “before vs. after” causation claim, the following data would be invaluable:

- Firm‑level reinvestment data: How much of retained foreign currency was redeployed into export generation (marketing, hiring, R&D)?

- Sectoral VC and private equity flows specifically to export‑oriented IT firms in FY25 (as opposed to general startup funding which fell markedly in 2024).

- STZ uptake metrics: number of firms operational in the new STZs and their export figures.

- Time‑series microdata on freelancer incomes and how much shifted into formal channels post‑retention rule changes.

Without these, the best we can do is make a measured causal claim supported by correlation, mechanism plausibility, and industry testimony.

The private investment paradox: VC down, exports up

An important tension in FY25 is that venture capital funding remained weak (reports show startup funding fell steeply in 2024, with some outlets estimating a ~70% decline) even as export numbers improved. This suggests that public policy — not private capital — may have provided the short‑run oxygen that exporters needed, or that freelancers and small firms (less dependent on VC) drove the gains.

This bifurcation matters because private capital typically fuels product development, international sales teams, and scaling beyond low‑margin contracts. If VC does not recover, Pakistan risks cementing a growth model dependent on cost‑competitive services rather than high‑value products.

Firm & freelancer perspective: cash flow, confidence, and reinvestment

Conversations with industry commentators (and public statements from PSEB and P@SHA) suggest the following plausible effects:

- Cash flow relief for exporters: Ability to retain foreign earnings means fewer forced conversions during volatile FX windows. That smooths operational planning.

- Greater confidence to bid on longer projects: When firms can hold some dollar reserves, they’re likelier to support multi‑quarter contracts.

- Freelancers moving toward formalization: If retention and payment facilities become friendlier, more freelancers might register as firms, improving export data clarity.

These are plausible behavioral responses, but every one needs quantitative confirmation.

Conclusion:

FY25’s policy and funding shifts appear to have created a friendlier environment for Pakistan’s IT exporters — easing currency flows, committing infrastructure dollars, and signaling government support. Early export data are encouraging, but confirming that these moves actually caused the export acceleration will require more granular, firm‑level and flow‑level evidence. For now, the prudent reading is one of cautious optimism: policy changes helped clear some immediate obstacles, but long‑term competitive upgrading will need private investment, skills development, and consistent policy implementation.

Leave a Reply