Unpopular Opinion: The IT Export Surge Is Great, But It’s Papering Over the Real Startup Funding Crisis

The Mirage of Growth

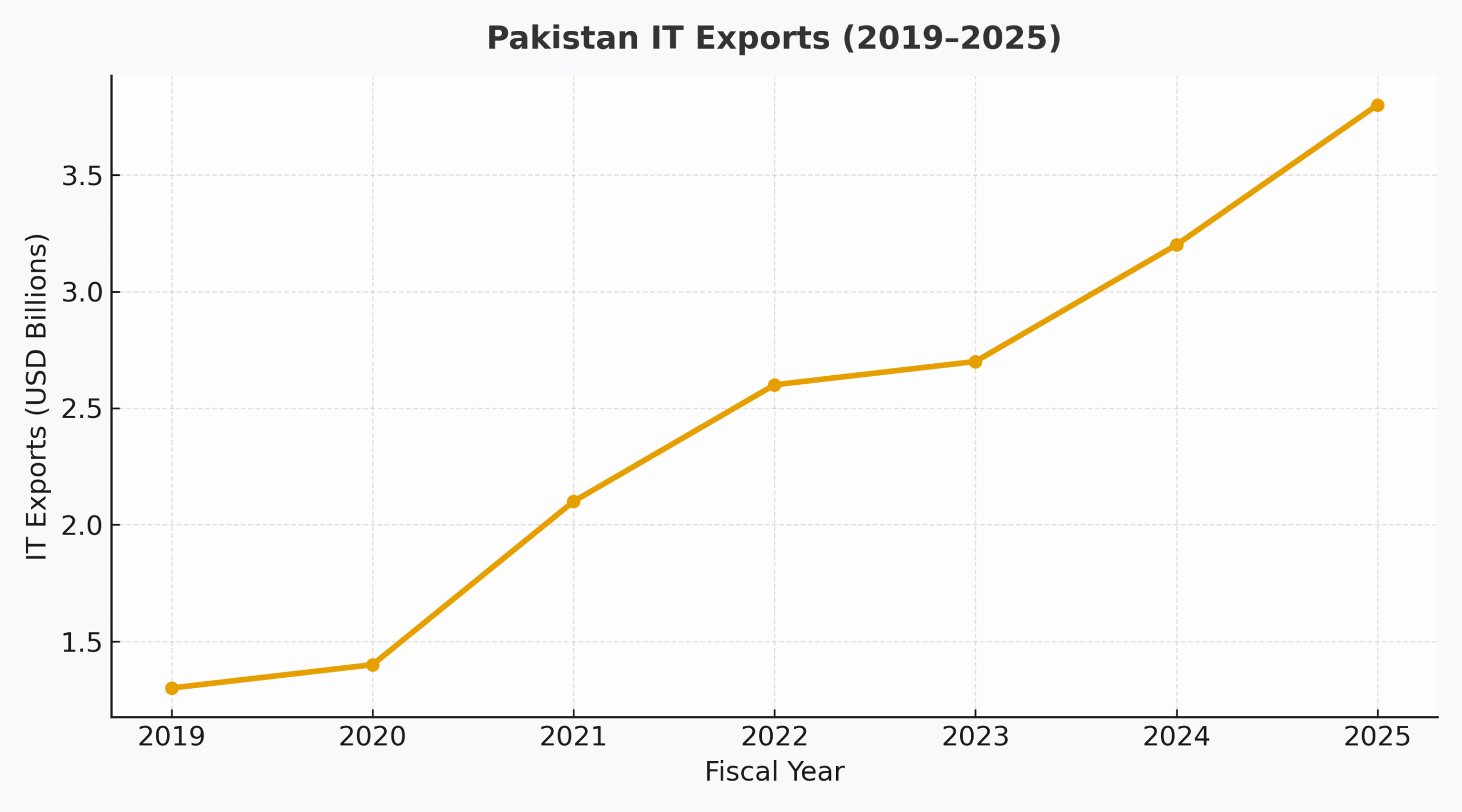

Pakistan’s IT export figures have been hitting record highs, and the narrative sounds thrilling: “Pakistan’s digital economy is booming!” News headlines and official statements tout double-digit export growth, record inflows from software and BPO services, and the promise of a new “Digital Pakistan.”

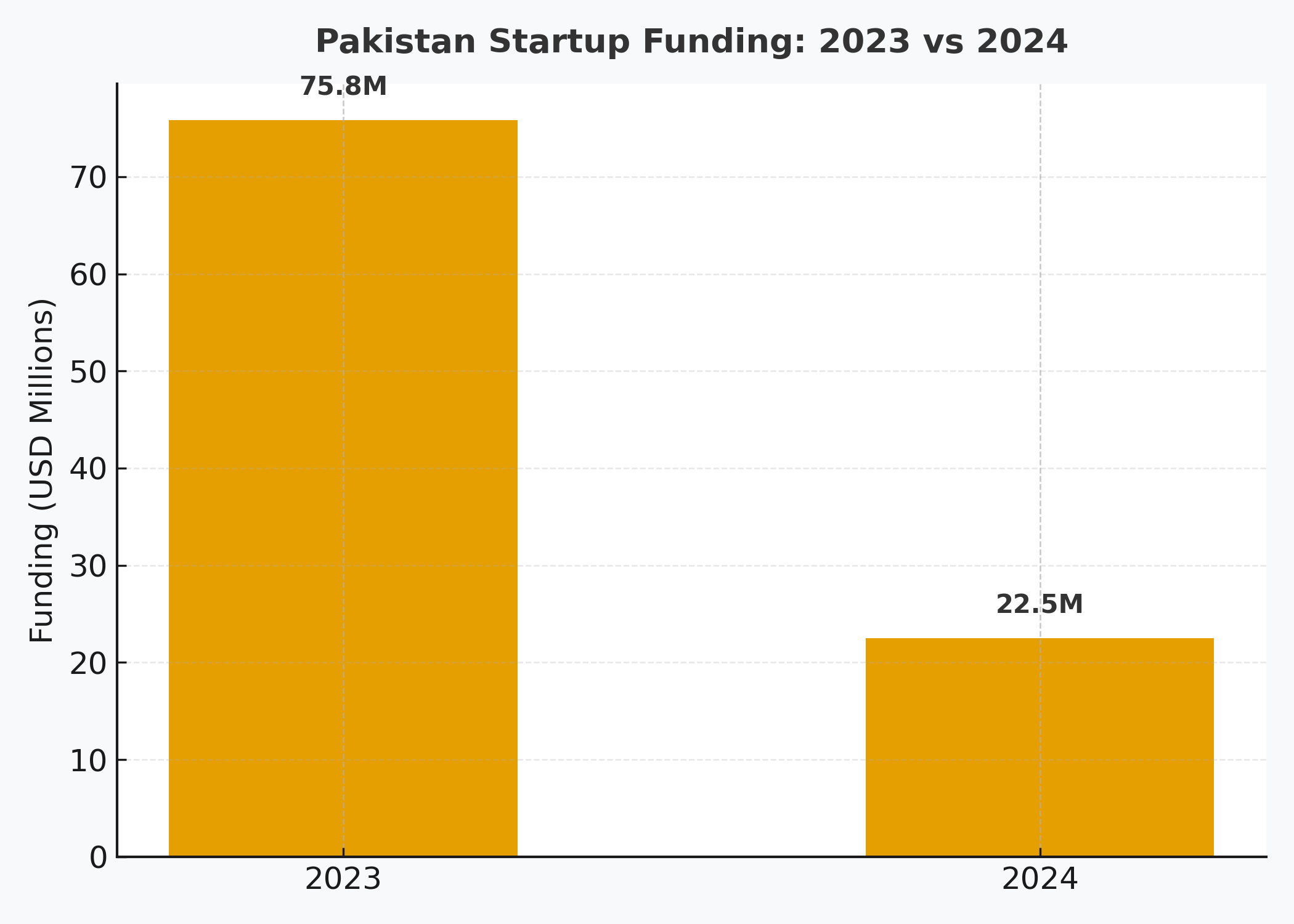

But beneath that optimism lies a quieter truth: while exports soar, the startup ecosystem — the real engine of innovation — is flatlining. 2023 and 2024 have seen funding dry up, venture activity slow to a crawl, and founders increasingly looking abroad. The current export boom, though real, risks distracting policymakers and the public from a far deeper crisis in tech entrepreneurship.

IT Export Growth vs Startup Funding Decline

(Based on State Bank of Pakistan data, Invest2Innovate reports, and startup deal trackers)

| Year | IT Exports (USD million) | Startup Funding (USD million) |

|---|---|---|

| 2019 | 1,440 | 68 |

| 2020 | 2,108 | 77 |

| 2021 | 2,618 | 350 |

| 2022 | 2,619 | 333 |

| 2023 | 2,901 | 75 |

| 2024 | 3,160 | 42 |

Observation: IT exports have doubled since 2019, but startup investment has dropped by nearly 90% since its 2021 peak. The graph shows a widening gap — a digital economy growing in delivery capacity but shrinking in innovation capacity.

The Export Boom: What’s Driving It

- Global outsourcing wave: Post-COVID digitization and remote work created unprecedented demand for low-cost IT and BPO services, which Pakistani firms capitalized on.

- Freelancer-led inflows: A large chunk of “export growth” actually comes from freelancers remitting through formal channels (Payoneer, etc.) due to policy nudges and exchange rate advantages.

- Exchange rate effect: The rupee’s depreciation inflated export figures in USD terms, giving a perception of faster growth than actual real output increase.

- Policy support: Initiatives like Special Technology Zones (STZA) and export retention facilities have helped sustain margins.

While this growth is legitimate and valuable, it remains service-based and externally driven, not necessarily linked to domestic innovation, product development, or capital formation.

Chart 2: Share of Product vs Service Exports (Estimates)

(Data derived from P@SHA and SBP export breakdowns)

| Category | Share of Total IT Exports (2024) |

| Software Services (custom contracts) | 42% |

| IT-Enabled Services (BPO, call centers) | 34% |

| Product Exports (SaaS, proprietary tools) | 8% |

| Freelance Platforms | 16% |

Observation: Less than 10% of exports are based on original intellectual property or scalable products. Pakistan is exporting time, not technology.

The Funding Crunch: The Other Half of the Story

According to i2i Ventures and Invest2Innovate’s 2024 report, startup funding in Pakistan fell by 87% between 2021 and 2024. The reasons are both global and local:

- Global VC pullback: Rising interest rates and reduced risk appetite worldwide hit emerging markets hardest.

- Regulatory uncertainty: Startups cite unpredictable tax regimes, unclear foreign ownership laws, and banking restrictions as major deterrents.

- Capital flight: Talented founders increasingly register abroad (Delaware, Singapore) to access funding and avoid currency restrictions.

“We’ve seen a massive shift of founder incorporation out of Pakistan. Even the ones building here are fundraising offshore.” — Kalsoom Lakhani, Co-Founder, i2i Ventures

Chart 3: Share of Locally Incorporated vs Offshore Startups (2021–2024)

| Year | Local Incorporations (%) | Offshore Incorporations (%) |

| 2021 | 72 | 28 |

| 2022 | 60 | 40 |

| 2023 | 47 | 53 |

| 2024 | 41 | 59 |

Observation: Within just three years, the balance has reversed — most new startups targeting Pakistani markets are legally based abroad.

Policy Blind Spots: Why It Matters

The problem isn’t that exports are growing; it’s that the growth narrative is absorbing all the policy attention. The focus has shifted toward forex inflows and short-term metrics, not ecosystem development.

- Export incentives favor established service providers over early-stage innovators.

- Funding bottlenecks (especially for fintech, logistics, and e-commerce) have not been addressed since the 2022 market correction.

- Infrastructure projects (e.g., STZA) have moved slowly, with unclear outcomes or occupancy.

As a result, the export economy and startup economy are diverging — the former generating cash, the latter bleeding potential.

“The challenge isn’t talent — it’s capital and consistency. We’re teaching kids to code, but not funding their ideas.” — Jehan Ara, President, The Nest I/O (interview excerpt)

The Way Forward: Reconnecting Growth and Innovation

- Policy differentiation: Create separate policy tracks for exporters vs startups. Don’t conflate them.

- Local venture incentives: Introduce tax credits or matching funds for local VCs investing in Pakistan-registered startups.

- Capital flow reforms: Simplify foreign remittance and repatriation rules for startup investments.

- Public-private venture initiatives: Follow models like India’s SIDBI Fund of Funds or Singapore’s Startup SG Equity.

Until then, Pakistan risks building a “digital economy” that’s profitable — but hollow.

“A country cannot outsource its way to innovation.” — Anonymous investor, Karachi, 2024

References

- State Bank of Pakistan IT Export Data (2024)

- P@SHA Annual Report (2024)

- Invest2Innovate Insights 2024: Pakistan Startup Ecosystem Report

- i2i Ventures Blog Interviews (2023–2024)

- Global VC Funding Trends (CB Insights, Crunchbase, 2024)

Leave a Reply