Why the Falling Rupee, And Not The Government Plans, Drove Record IT Exports

An evidence-based look at the hidden engine behind Pakistan’s digital export surge

By Naoman Saeed

Published on December 02, 2025

The Headline Everyone Celebrated

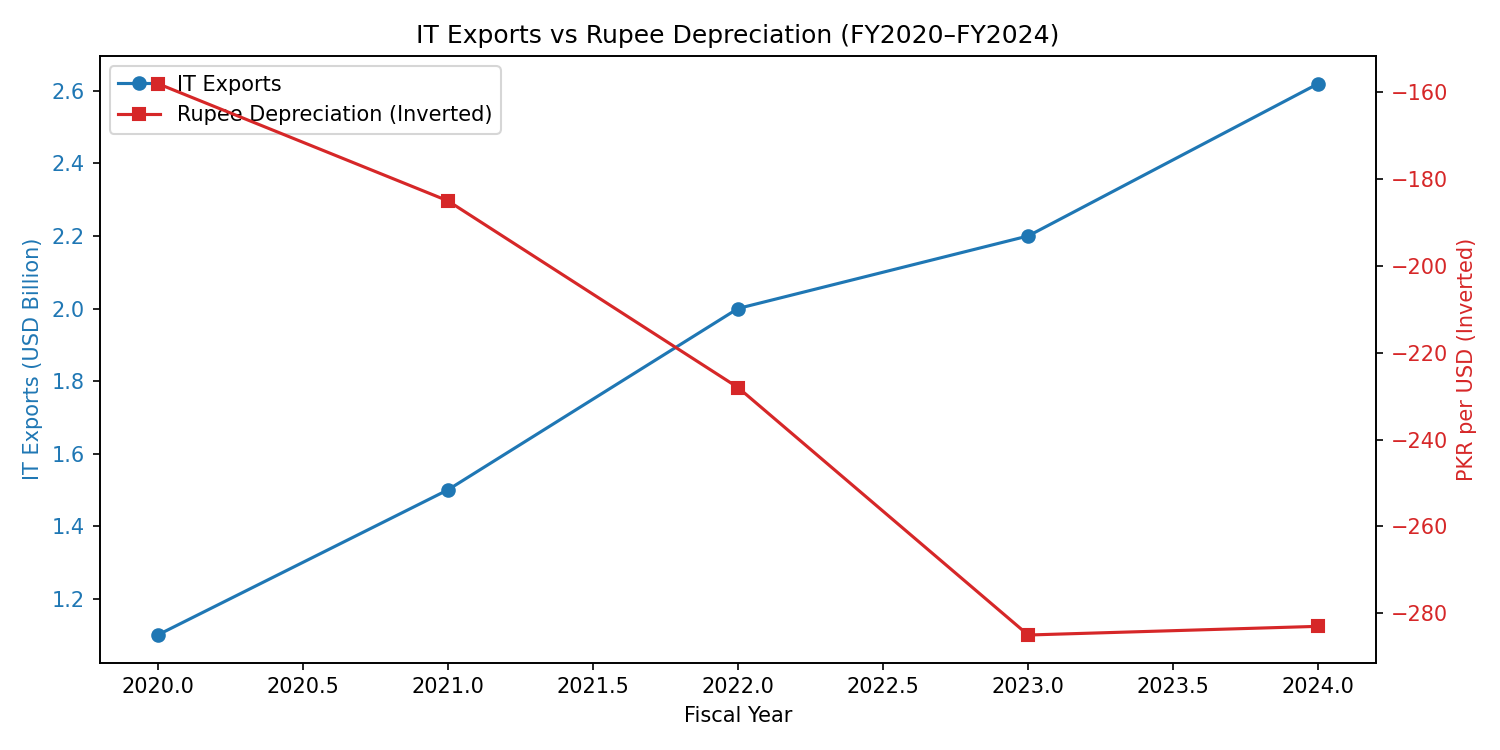

In fiscal year 2024, Pakistan’s IT and IT-enabled services exports hit $2.62 billion—a record high and more than double the $1.1 billion recorded just four years earlier in FY2020.

Government press releases hailed the success of the Digital Pakistan Policy, tax exemptions, and Roshan Digital Accounts. Industry leaders echoed the sentiment: “Policy is working,” they said.

But a closer look reveals a different story—one driven less by strategy and more by macroeconomic circumstance.

Between 2021 and 2023, the Pakistani rupee lost nearly half its value against the US dollar. That collapse didn’t just signal economic distress—it quietly supercharged the earnings and competitiveness of every freelancer, startup, and IT firm billing in dollars.

This isn’t to dismiss policy. But the data suggests: the falling rupee was the real engine.

The Numbers Don’t Lie: Exports Rose as the Rupee Fell

Let’s align the two trends.

IT Exports (FY2020–FY2024)

| Fiscal Year | IT Exports (USD) | YoY Growth |

|---|---|---|

| FY2020 | $1.1 billion | — |

| FY2021 | $1.5 billion | +36% |

| FY2022 | $2.0 billion | +33% |

| FY2023 | $2.2 billion | +10% |

| FY2024 | $2.62 billion | +19% |

Source: State Bank of Pakistan (SBP), Pakistan Software Export Board (PSEB)

PKR/USD Exchange Rate (Year-End / FY Avg)

| Year | Approx. PKR per USD |

|---|---|

| 2021 | 158 |

| 2022 | 228 |

| 2023 | 308 (peak), ~285 avg |

| 2024 | ~280–285 |

Source: SBP, Forex.pk, Open Market Rates

Notice the pattern? The steepest export growth (FY2021–FY2022) happened precisely when the rupee was plummeting fastest. Even during Pakistan’s worst economic crisis in decades (2022–2023), IT exports kept climbing—unlike textiles, agriculture, or remittances, which all faced headwinds.

How a Weaker Rupee Translates to Real Gains

Most Pakistani digital service providers—freelancers, agencies, and even mid-sized firms—price their work in US dollars. When the rupee falls, their local-currency income surges without changing a single client contract.

Example: A Freelance Developer

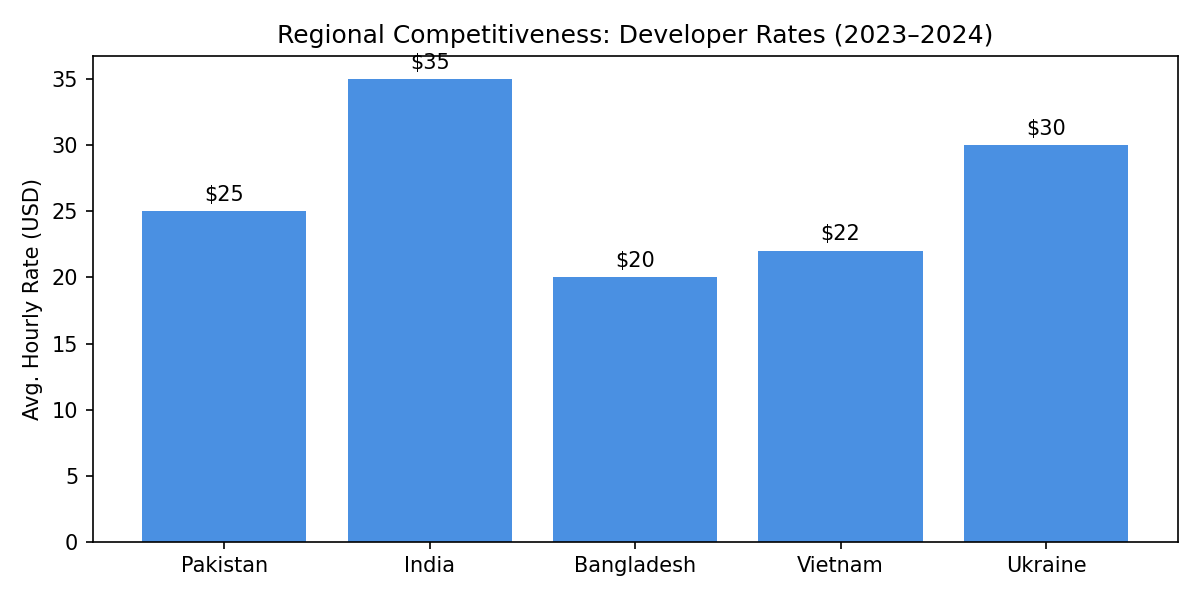

- Charges $25/hour (competitive global rate for mid-level dev)

- In January 2021 (PKR 158/USD): Earns PKR 3,950/hour

- In August 2023 (PKR 308/USD): Earns PKR 7,700/hour

→ That’s a 95% increase in take-home pay—without raising prices or working more hours.

This effect rippled across:

- Freelancers on Upwork, Fiverr, and Toptal (Pakistan now ranks among Top 5 global freelancer nations by volume)

- Small IT firms serving US/EU clients

- Remote employees working for foreign companies

Suddenly, Pakistani talent wasn’t just “affordable”—it was impossibly cost-effective. Clients got the same quality for 30–50% less in dollar terms compared to Indian or Eastern European peers.

What Policy Actually Delivered (and What It Didn’t)

To be fair, the government did remove key barriers:

- ✅ 100% income tax exemption on IT exports (renewed through 2025)

- ✅ Roshan Digital Accounts enabled legal USD inflows (over $1 billion received by freelancers and IT exporters by 2024)

- ✅ Streamlined company registration via SECP’s e-portal

But critical gaps remain:

- ❌ No direct PayPal or Stripe access—forcing reliance on expensive third-party gateways (3–8% fees)

- ❌ No national digital ID or e-residency to simplify cross-border contracts

- ❌ Inconsistent internet reliability outside Karachi, Lahore, Islamabad

In short: Policy created a runway—but the falling rupee provided the thrust.

The Danger of Mistaking Luck for Strategy

Here’s the uncomfortable truth: currency-driven growth is fragile.

- If the rupee stabilizes or appreciates (e.g., due to IMF support or improved reserves), Pakistan’s price advantage evaporates overnight.

- Over-reliance on low rates can discourage investment in quality, innovation, or product development—locking the sector into a “cheap labor” trap.

- Early warning signs are already visible: export growth slowed to just 10% in FY2023, even with a weak rupee—suggesting demand may be plateauing.

Compare this to India, which grew IT exports to $194 billion in 2023—not by being the cheapest, but by delivering enterprise-grade solutions, owning IP, and building global brands.

Building Real Competitiveness: What Comes Next?

Pakistan must use this FX windfall to invest in lasting advantage:

- Upskill aggressively in AI, cloud, and cybersecurity—areas where value isn’t tied to hourly rates.

- Shift from services to products: Support SaaS startups that generate recurring revenue, not one-off contracts.

- Fix payment infrastructure: Lobby for direct integration with global fintech rails (even stablecoin corridors).

- Improve soft infrastructure: Data protection laws, e-dispute resolution, and digital notarization.

The goal isn’t to keep the rupee weak—it’s to make Pakistan’s digital talent indispensable, regardless of exchange rates.

Conclusion: Give Credit—But Don’t Confuse Cause and Effect

Yes, policy laid groundwork.

But the real catalyst for Pakistan’s IT export record was the falling rupee—a macroeconomic shock that, for once, worked in the tech sector’s favor.

Now comes the hard part: converting this temporary advantage into permanent strength. Because when the rupee eventually recovers, only those who built real value—not just low prices—will survive.

The clock is ticking.

Naoman Saeed is a technologist and economic observer tracking digital transformation in South Asia.

Sources: State Bank of Pakistan, Pakistan Software Export Board (PSEB), Ministry of IT & Telecom, TechJuice, World Bank Exchange Rate Data.

Leave a Reply