Pakistan’s freelancing sector stands as one of the brightest stories in the country’s digital economy. With an estimated 1.5–2 million active freelancers, the nation consistently ranks among the top five freelance markets in the world. These independent professionals generate hundreds of millions of dollars annually in remote export earnings — yet, despite this immense potential, a huge share of their income never officially enters Pakistan’s economy.

The culprit? Outdated, fragmented financial systems that make it unnecessarily difficult for freelancers to receive, save, and reinvest their hard-earned income. This is not a story of talent shortage — it’s one of structural inefficiency and policy inertia.

The Scale of the Problem: Billions Lost in Untracked Earnings

A thriving but undercounted sector

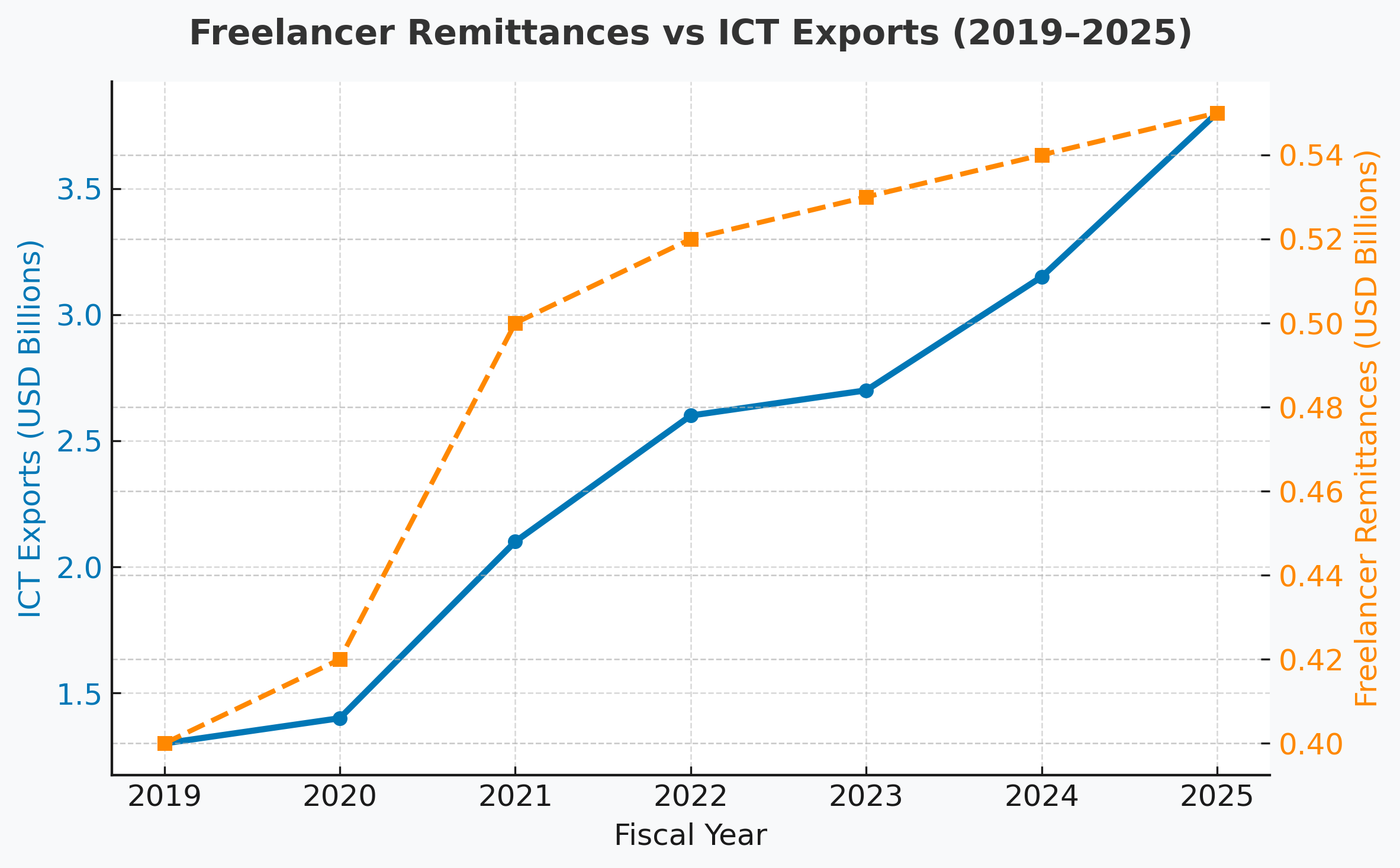

While Pakistan’s official IT and ICT export figures stood at $2.6 billion in FY24 (as per State Bank of Pakistan data), independent estimates place the true number much higher — some say $5 to $7 billion when factoring in remittances through informal or third-party channels.

These “missing billions” represent freelancers who are paid through Payoneer, crypto, or even relatives’ accounts abroad, bypassing the domestic banking network altogether. The motivation isn’t evasion; it’s frustration — with low withdrawal limits, long clearance times, poor exchange rates, and complicated compliance rules that make Pakistan’s digital payments ecosystem uncompetitive.

Why Legacy Systems Are to Blame

1. Limited payment integration

Despite Pakistan’s talent in global freelancing platforms, the country still lacks full PayPal and Stripe access — two platforms that collectively handle most of the world’s freelance transactions. The absence of such gateways forces freelancers to rely on third-party intermediaries or informal methods.

2. Bureaucratic and outdated banking infrastructure

While digital banking is growing fast — thanks to initiatives like Raast and new EMI (Electronic Money Institution) licenses — most traditional banks still treat foreign remittances as high-risk or low-priority. Many freelancers report being questioned or blocked from receiving payments under $500, even when fully legitimate.

3. Policy gaps and outdated classification

Freelancers occupy a gray area between “exporter” and “individual service provider.” This lack of clarity means no dedicated policy framework exists for taxation, banking limits, or export recognition — leaving professionals vulnerable to inconsistent treatment by both banks and regulators.

The Opportunity Cost: What Pakistan Is Losing

The untracked earnings from freelancers not only distort the true scale of the IT export sector — they also represent missed opportunities for national reserves, investment, and growth.

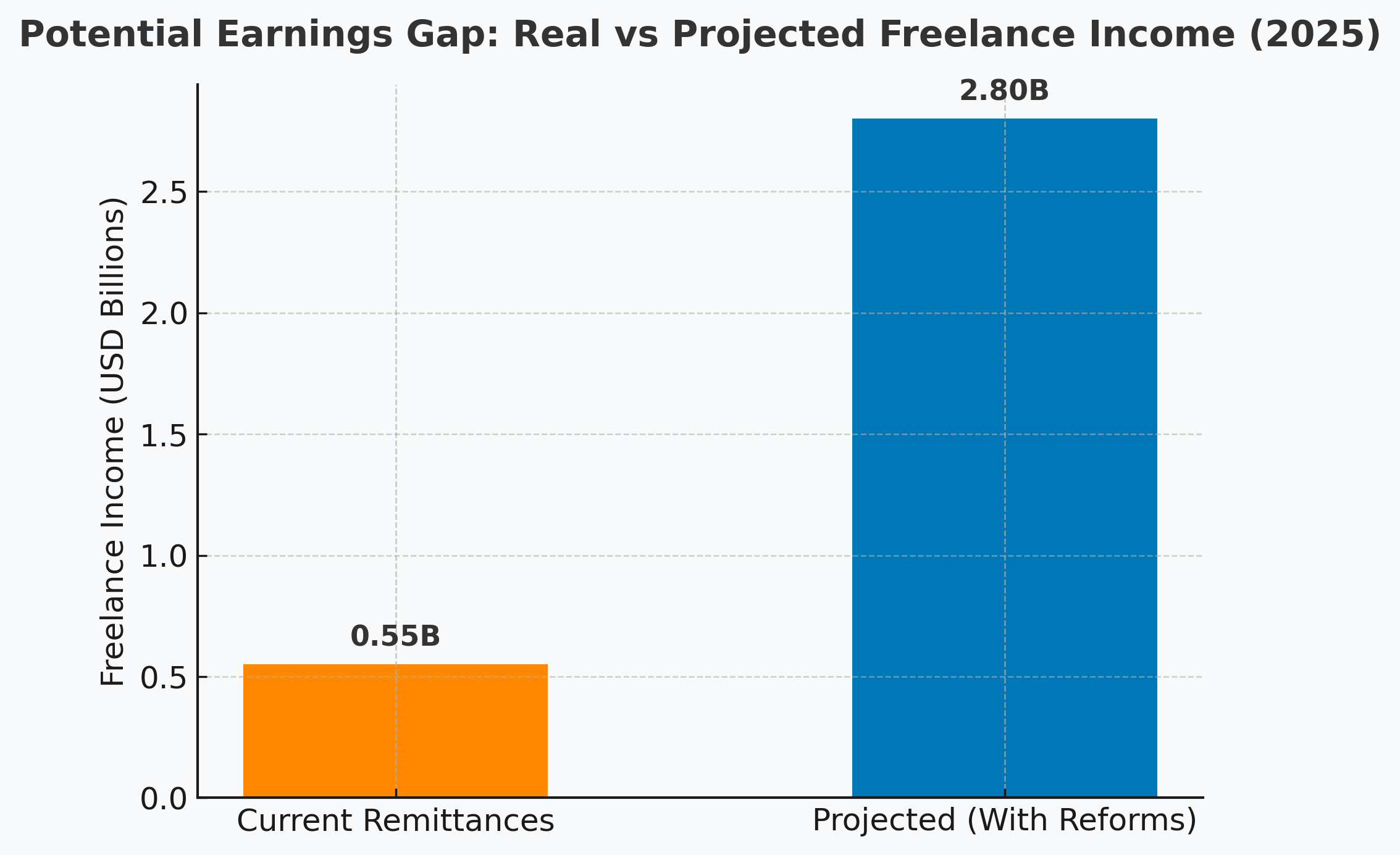

Hypothetical estimate:

If even half of the estimated $7 billion in freelance earnings were routed through official channels, Pakistan’s documented IT exports could rise by over 70%, improving current account balances and enhancing the country’s global credit reputation.

At the micro level, this also means that tens of thousands of freelancers could have access to better credit histories, small business loans, and digital investment tools — setting off a ripple effect of formalization and entrepreneurship.

Reform Momentum: What’s Changing in 2025

1. Raast expansion to global remittance flows

The State Bank’s Raast system — Pakistan’s real-time payment infrastructure — has begun trials for cross-border integration. This could allow freelancers to receive global payments directly into local digital wallets or bank accounts with minimal fees.

2. EMI and fintech licenses

Several fintech startups such as SadaPay, Nayapay, and Paymob have obtained regulatory clearance to handle international transactions more efficiently. While not yet full PayPal substitutes, these companies are closing the gap by offering USD accounts and instant conversions.

3. Policy attention to IT exports

The Digital Pakistan Policy (2025 draft) reportedly includes incentives for freelancers to bring funds through formal channels — such as preferential exchange rates and tax exemptions for verified IT exporters. Though still under discussion, this marks a long-overdue shift toward recognition.

What Needs to Happen Next

- Faster integration with global payment systems. Pakistan must prioritize bilateral and compliance arrangements with PayPal and Stripe.

- Dedicated freelance banking channels. Banks and fintechs should collaborate on streamlined accounts that automatically classify legitimate freelance income.

- Tax and policy clarity. A unified freelancer framework — possibly under the Ministry of IT — could end the confusion between personal and business remittances.

- Digital financial literacy. Many freelancers are unaware of compliant, efficient routes for receiving funds — a nationwide awareness campaign could dramatically increase official inflows.

Conclusion: The Digital Workforce Deserves a Modern System

Pakistan’s freelancers are not just gig workers — they are exporters, innovators, and ambassadors of the country’s digital potential. But as long as the system continues to treat them like anomalies instead of assets, Pakistan will keep leaking billions of dollars in invisible exports every year.

The problem is not capability — it’s connectivity. And 2025 may finally be the year Pakistan begins to fix that.

Leave a Reply