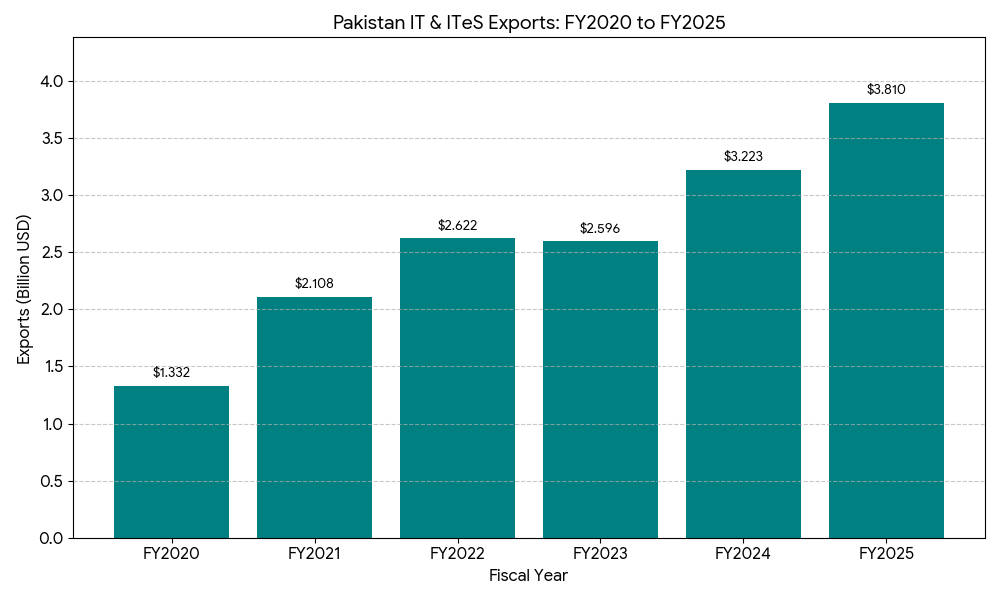

From $2B to $3.8B: A Timeline of the Key Events That Fueled Pakistan’s IT Export Growth

Pakistan’s IT export story is no longer a hopeful projection — it’s a verified trajectory. In just four years, the country’s digital services sector has nearly doubled, climbing from just over $2 billion in FY 2020-21 to $3.8 billion by FY 2024-25.

This surge didn’t happen by accident. It’s the product of intertwined factors: global demand shocks, pandemic-era digitization, financial reforms, and gradual policy awakening.

Each year since 2020 has played a distinct role — some advancing growth, others exposing structural cracks.

(Insert Chart 1: “Pakistan’s IT Export Growth FY 2020–2025” — a clean upward-trending bar graph showing values from $2.12B to $3.8B)

2020–21: The Pandemic Push and Pakistan’s First $2B Year

Before 2020, Pakistan’s tech exports had hovered below $2 billion for almost a decade. Then came a global pandemic that changed everything.

With lockdowns forcing businesses worldwide online, Pakistani software houses, freelancers, and BPO firms suddenly found themselves flooded with contracts — especially from the US, Gulf, and UK.

Freelance marketplaces like Upwork and Fiverr saw record activity, and Payoneer inflows surged 30%. The State Bank of Pakistan (SBP) reported IT exports of $2.12 billion, marking the first major psychological milestone.

“It wasn’t just luck. The pandemic compressed five years of digital transformation into one,” said P@SHA chairperson in a 2021 interview.

It was a breakthrough year — but also the beginning of structural dependence on global outsourcing.

2021–22: Financial Flexibility and Consolidation

Having proven its potential, the sector needed financial breathing space. The government’s Export Facilitation Scheme and SBP’s revised export retention rules allowed IT firms to keep a portion of their earnings in foreign currency accounts.

This single policy tweak helped companies reinvest abroad — paying for tools, cloud services, and overseas marketing. Exports grew to $2.62 billion, a 23% increase from the previous year.

At the same time, Raast, Pakistan’s instant payment system, began linking with freelancers and SMEs, reducing friction in digital payments.

(Insert Chart 2: “Policy and Payment Milestones 2020–2022” — a timeline visualization with events like ‘SBP export account reform’, ‘Raast rollout’, ‘STZA Act passed’)

It was also the year when the Special Technology Zones Authority (STZA) became operational, promising tax breaks and infrastructure for IT companies.

2022–23: The Plateau and Policy Whiplash

After two years of unbroken rise, FY 2022–23 brought a dose of realism. Despite continued demand from abroad, the sector’s exports stagnated at around $2.6 billion.

What happened?

A mix of policy inconsistency and global slowdown. Pakistan’s repeated changes in tax policy, combined with delayed refund processing and unclear definitions of IT exports, rattled investor confidence. Meanwhile, global venture capital dried up as the “startup winter” set in.

Many firms began withholding proceeds abroad due to uncertain SBP clearance timelines. The Pakistan Software Export Board (PSEB) quietly warned in mid-2023 that the slowdown could persist unless banking reforms were made permanent.

Yet, even in this slowdown, the groundwork for recovery was being laid.

2023–24: The Recovery and the Institutional Backbone

By FY 2023–24, the narrative began shifting again — cautiously. The SBP’s export account rules were revised once more, allowing IT exporters to retain up to 50% of their earnings in foreign currency accounts.

This reform, long demanded by the industry, unlocked over $200 million in previously trapped proceeds. STZA also gained traction, with new zones approved in Islamabad, Lahore, and Karachi.

Meanwhile, Raast continued to expand its API layer, linking to freelancers through fintech intermediaries like Sadapay and Nayapay. The result: faster inflows, better record-keeping, and rising trust.

Exports climbed to $3.2–$3.3 billion — modest on paper, but significant in rebuilding credibility.

“This year wasn’t about numbers — it was about stability,” noted Tech Destination Pakistan’s midyear report.

(Insert Chart 3: “Impact of Reforms on IT Export Growth” — a line + milestone chart showing correlation between major reforms and export jumps)

2024–25: The $3.8B Leap and the ‘Almost There’ Moment

By 2025, Pakistan’s IT exports were brushing $3.8 billion, putting the country within striking distance of the $4 billion mark.

The Finance Division’s 2024 rationalization of tax incentives helped major exporters re-register locally, reversing an offshoring trend. Collaboration between PSEB, STZA, and Ignite started bearing fruit — with integrated incubators, shared infrastructure, and a pipeline of export-ready startups.

Crucially, the sector’s reputation improved abroad. The global freelance community recognized Pakistan not only as a cheap outsourcing destination but also as a serious mid-tier software economy.

Digital public infrastructure, such as the National Data Exchange Layer (NDEL) and AI Policy 2025, further strengthened the ecosystem, signaling a maturing state apparatus around the digital economy.

Cautionary Note: Beyond the Numbers

While the upward curve is worth celebrating, it hides persistent fragilities.

The export base remains narrow — heavily concentrated in North America and reliant on service exports rather than product development. Local reinvestment remains weak; many firms continue to park earnings abroad.

Talent retention is another challenge. As global remote work remains normalized, Pakistan risks losing its best engineers to foreign payrolls.

Meanwhile, the tax environment remains unpredictable — despite recent improvements. Repeated reversals in export exemptions and unclear definitions of “IT-enabled services” still deter foreign clients.

The story, in short, is not yet of victory — but of endurance and delicate momentum.

Conclusion: The Path to 2026

If Pakistan’s IT exports cross $4 billion in FY 2025–26, it will symbolize more than a number. It will represent a sustained economic transformation that began under duress — during a global pandemic — and matured through persistence, not luck.

But to convert this surge into permanence, policy consistency, infrastructure investment, and diversification must remain non-negotiable.

The next milestone isn’t $5 billion — it’s building a self-sustaining digital economy that no longer depends on external shocks to thrive.

Leave a Reply