5 Trends Powering Pakistan Toward $4B+ IT Exports in 2026

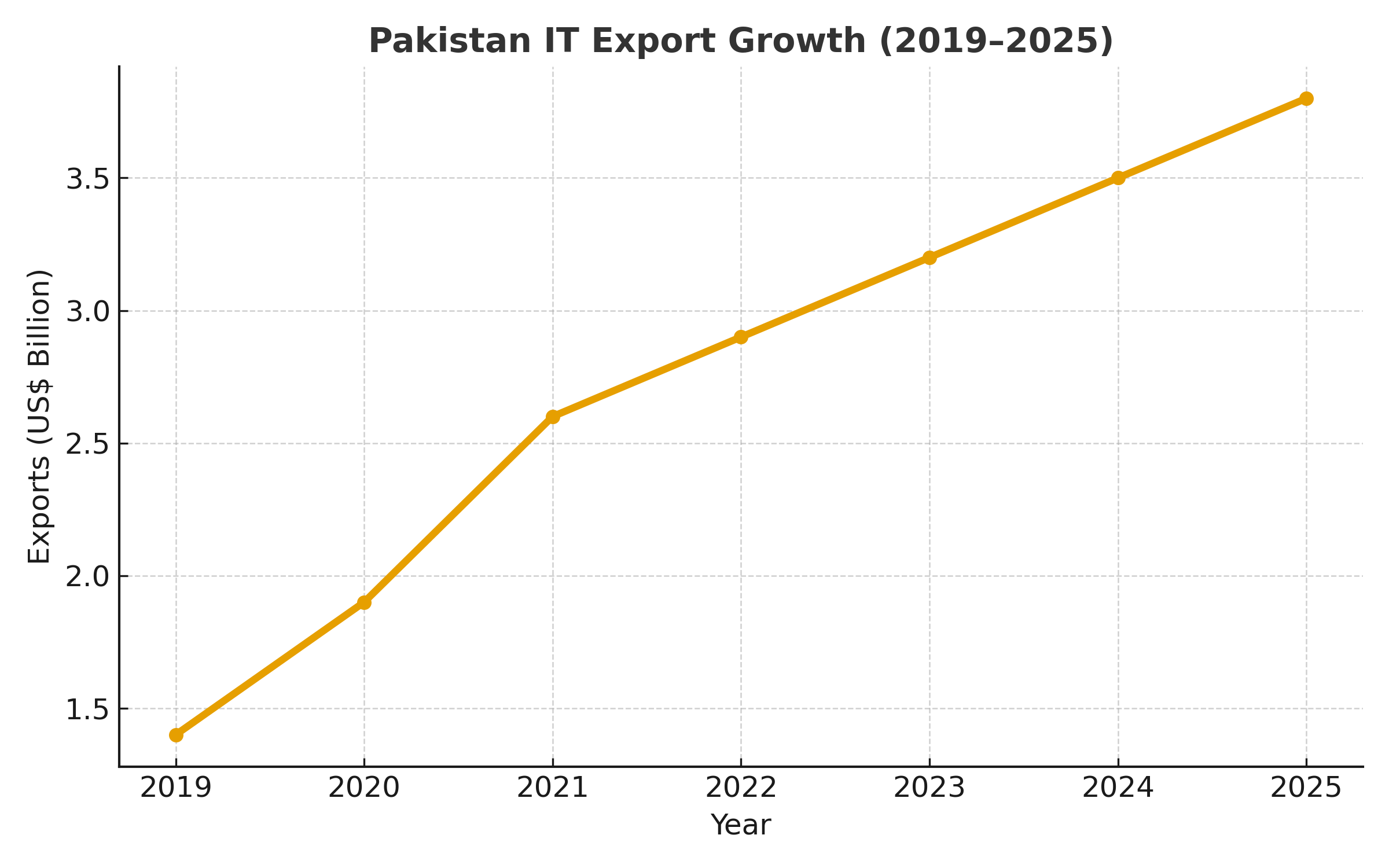

Pakistan’s IT export industry is showing extraordinary resilience. Despite currency fluctuations, global uncertainty, and domestic challenges, the sector brought in nearly $3.8 billion in FY2025—its highest-ever figure. At this trajectory, crossing $4 billion in 2026 seems not just plausible but highly probable. Yet, what’s driving this momentum isn’t luck. It’s a convergence of five powerful trends reshaping how Pakistan participates in the global digital economy.

1. The Rise of AI-Driven Freelancing and Remote Work

Pakistan’s freelancing sector is evolving rapidly. Platforms like Upwork, Fiverr, and Toptal now list a growing number of Pakistani professionals offering AI-assisted services: prompt engineering, automation workflows, and data annotation for machine learning pipelines. As generative AI tools lower entry barriers, more freelancers are moving up the value chain—from basic design and development tasks to high-value AI integration and consulting.

Why It Matters: These professionals aren’t just earning more; they’re bringing in foreign exchange at scale, with exports from freelancing expected to cross $1 billion by 2026 if current growth continues.

2. Tech Infrastructure and Policy Reforms Taking Hold

The government’s focus on IT exports is finally being matched with tangible action. The Special Technology Zones Authority (STZA) has operationalized several key zones in Lahore, Islamabad, and Karachi, offering tax incentives and smoother regulatory frameworks. Meanwhile, the Pakistan Software Export Board (PSEB) is pushing forward digital skills training, startup facilitation, and export certification programs.

Why It Matters: Infrastructure that once existed only on paper now has real physical and financial support behind it. For investors and companies scaling operations, the environment is becoming less hostile and more predictable.

3. A Generation of Global-Ready Tech Entrepreneurs

Unlike the previous decade, today’s Pakistani founders are building for global markets from day one. SaaS startups like Airlift’s early model, Bazaar Technologies, and Retailo have inspired a wave of export-focused entrepreneurs. The ecosystem now emphasizes recurring revenue models and foreign clientele, especially in areas like fintech APIs, cybersecurity, and enterprise software.

Why It Matters: These ventures aren’t dependent on local economic cycles. Their growth directly contributes to export revenue, and their success stories encourage new capital inflows and talent repatriation.

4. The Diaspora Advantage and Nearshoring Momentum

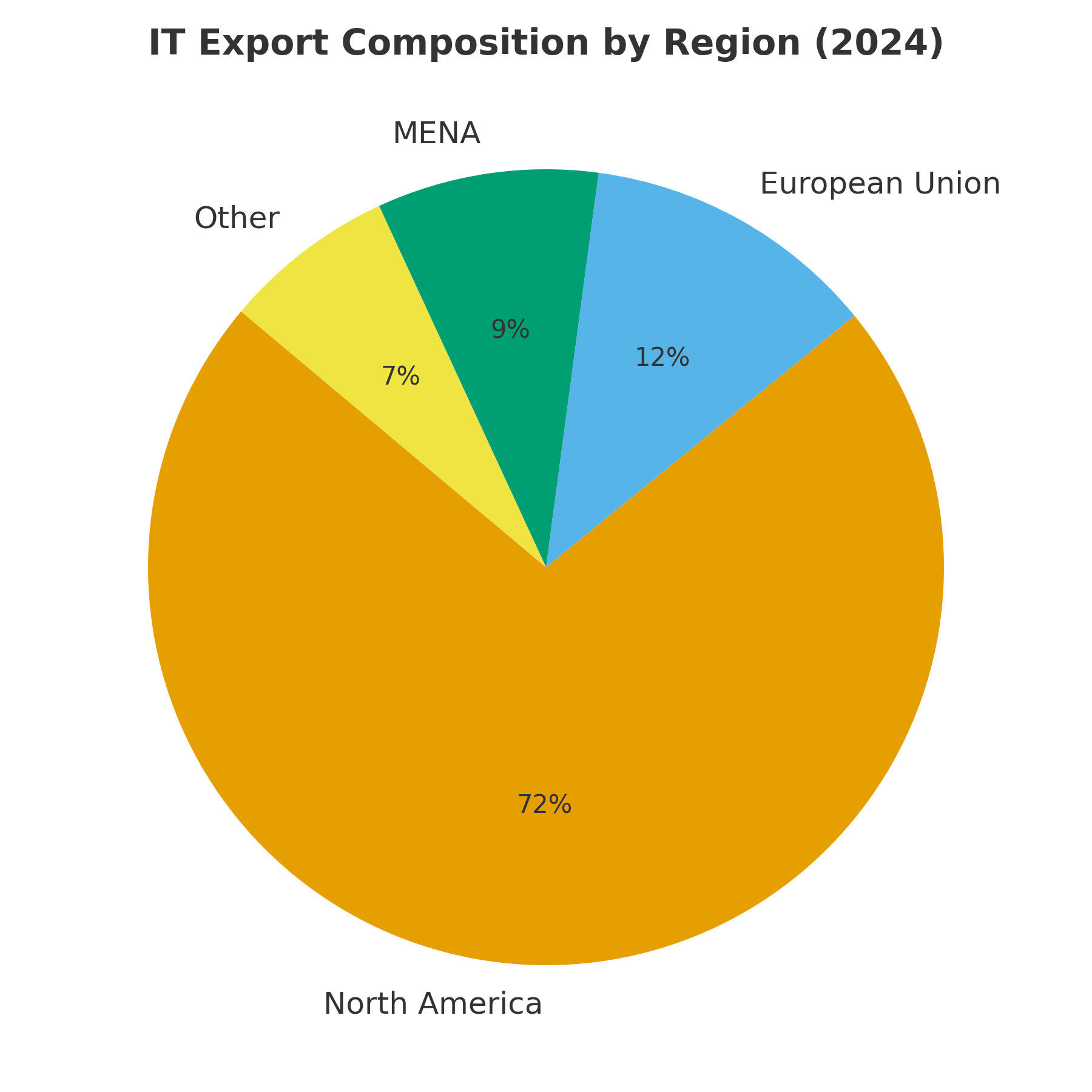

Pakistan’s global diaspora, especially in North America, the UK, and the Gulf, continues to play a strategic role. Many tech companies abroad are now outsourcing development and support functions to Pakistan-based teams they trust personally. Simultaneously, the nearshoring wave from the Middle East—as Gulf economies digitize—is opening lucrative new B2B opportunities.

Why It Matters: Instead of relying solely on Western markets, Pakistan is diversifying its export base, reducing vulnerability to single-region demand shocks.

5. Currency Dynamics and the Dollar Incentive

The rupee’s depreciation, while challenging domestically, continues to make Pakistani services globally competitive. Exporters are naturally incentivized to bring in more dollar revenue, while freelancers and companies alike are reinvesting earnings into scaling operations and training talent.

Why It Matters: This structural advantage won’t last forever, but for now, it acts as a temporary tailwind accelerating export growth and dollar retention.

⚠️ Cautionary Note: The Numbers Hide Uneven Ground

Even as Pakistan’s IT exports edge toward the $4 billion milestone, the landscape beneath remains fragile and uneven. Much of the export surge continues to depend on a narrow base of freelance and service-oriented contracts — software customization, business process outsourcing, and web development — that are highly sensitive to global demand swings. A mild recession or tightening in the U.S. or Gulf economies can shrink orders almost overnight. The State Bank’s own breakdown shows that around 72 percent of export inflows still originate from North American clients, making geographic concentration a persistent risk.

Domestic headwinds compound the issue. Power tariffs for commercial consumers rose nearly 60 percent between mid-2023 and late-2024, according to NEPRA, while imported hardware costs remain inflated due to currency depreciation. These squeeze margins for local IT firms and make hardware-heavy sub-sectors like data hosting or AI model training prohibitively expensive to scale inside the country. Consequently, a sizable share of Pakistan’s “digital exports” are processed offshore — through Dubai or Singapore-based accounts — which means the official figures may overstate net value retained locally.

The startup ecosystem tells a similar story of imbalance. Funding inflows that once touched $350 million in 2021 fell below $50 million in 2024, reflecting global venture capital caution and domestic regulatory uncertainty. Despite the export boom, risk capital remains scarce, leaving many founders dependent on project-based outsourcing rather than product innovation. The export success, in other words, is masking a hollowing-out of the local innovation pipeline.

Finally, the rise of generative AI is introducing both opportunity and threat. Global clients increasingly expect automation to replace low-skill coding, transcription, and design work — precisely the segments where Pakistan has excelled. Unless the workforce rapidly upskills in AI-assisted development and data engineering, today’s gains could plateau within two years. The new government’s AI Policy 2025 has signaled intent, but execution capacity and funding remain uncertain.

In short, the $4 billion mark will be a symbolic victory — but sustaining it will require diversification, infrastructure reform, and deeper human-capital investment. Without those, the next plateau could arrive sooner than anyone expects.

Conclusion: The Next Billion-Dollar Push

Pakistan’s IT exports are no longer a fringe success story; they’re a central pillar of the national economy. If the trends above continue, surpassing $4 billion in 2026 is almost a baseline expectation. The real question is whether policymakers and industry leaders can sustain the momentum long enough to reach $5 billion and beyond by 2027.

Leave a Reply