5 Trends Defining Pakistan’s IT Exports in 2025

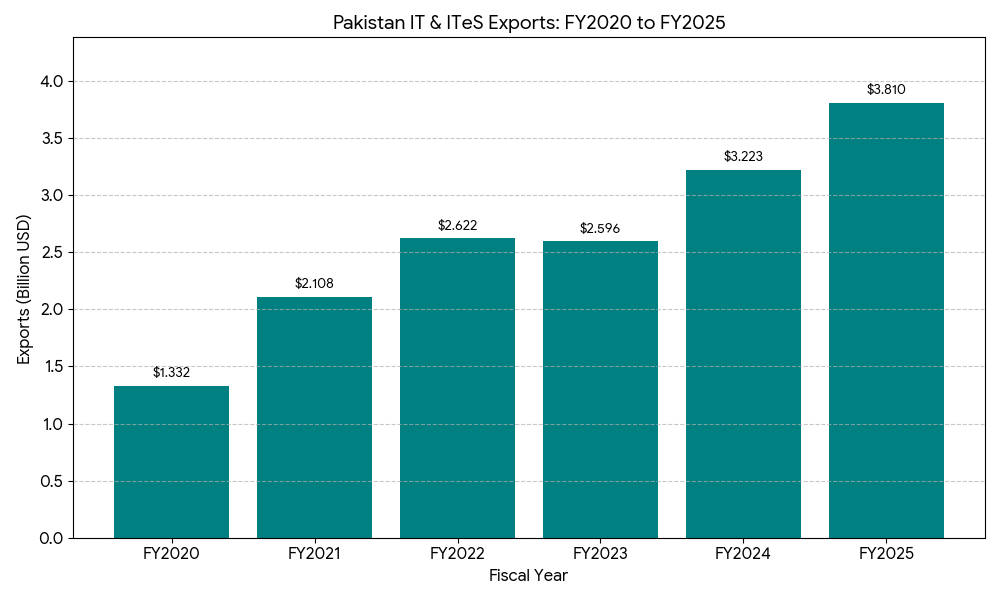

Pakistan’s IT and IT-enabled services (ITeS) sector has long been recognized as one of the country’s most promising engines for growth, and the latest export numbers confirm that momentum is building. According to official figures, Pakistan’s ICT exports crossed $1.05 billion in Q1 FY2025-26, reflecting a 20.5% year-on-year increase — a significant recovery after several years of volatility. But behind these impressive statistics lies a deeper transformation. The sector is evolving in structure, focus, and geography — and several key trends are driving this change.

This post unpacks five major forces shaping the future of Pakistan’s IT exports in 2025 and beyond.

1. Sustained Growth After a Period of Plateau

After nearly two years of stagnation, Pakistan’s IT exports have regained momentum. The 20.5% year-on-year growth in the first quarter of FY2025-26 isn’t merely a rebound — it’s a signal that the sector is adapting to macroeconomic challenges and regaining competitiveness.

This growth is driven by a combination of factors: a more stable exchange rate, the reintroduction of fiscal incentives, and improved payment repatriation mechanisms for freelancers and companies alike. Moreover, global demand for software development, remote IT support, and business process outsourcing (BPO) has remained robust, and Pakistani firms are now better positioned to capture this demand.

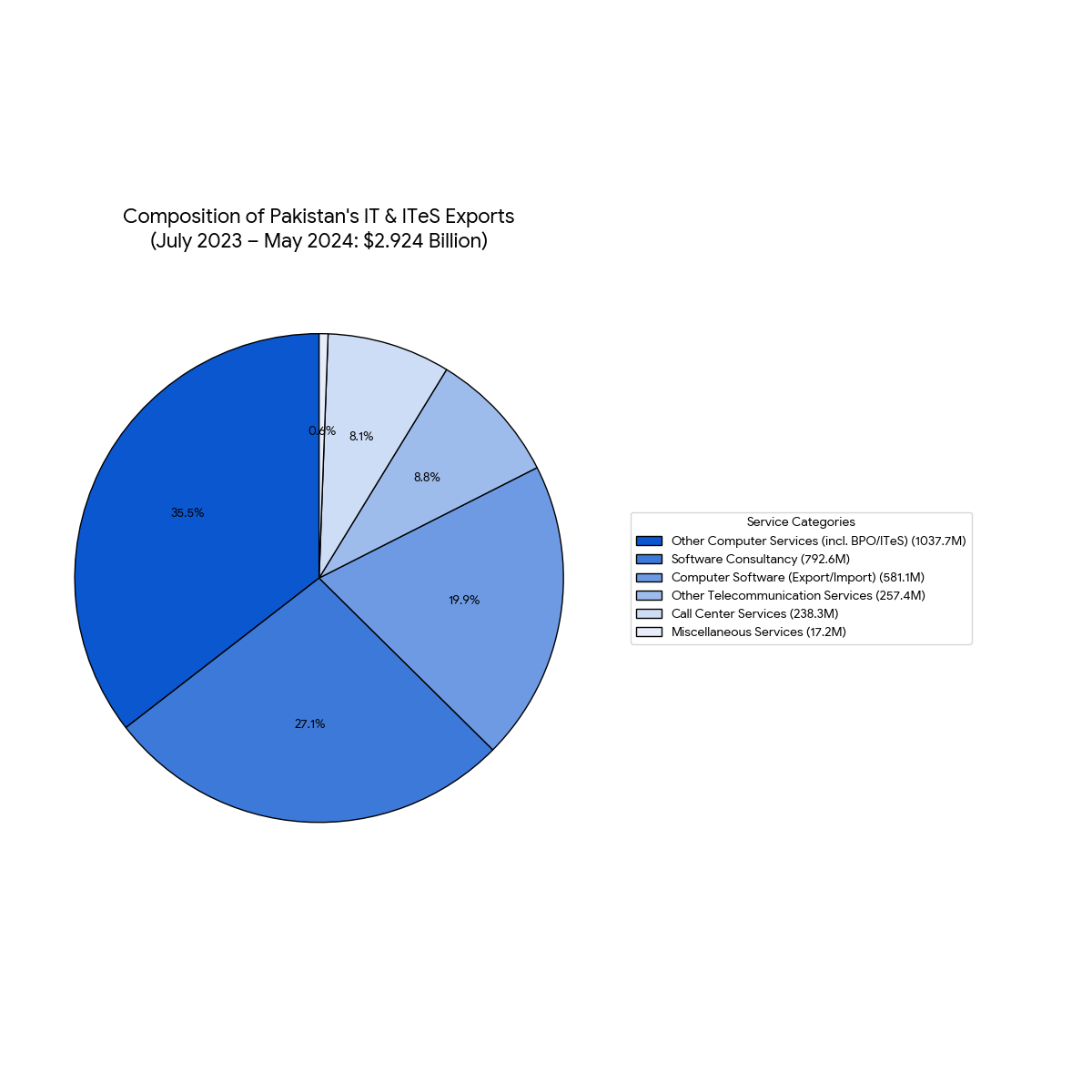

Industry insiders note that the composition of exports is also changing — with software and product-based services accounting for a larger share compared to traditional outsourcing.

2. Shift Toward Higher-Value Services

In the past, Pakistan’s IT exports were dominated by call centers and basic BPO. That model is changing rapidly. Today, more companies are moving up the value chain — offering AI development, data analytics, cloud migration, fintech solutions, and even cybersecurity services to global clients.

This shift reflects the maturation of local talent and the globalization of Pakistani tech firms. Companies such as 10Pearls, Systems Limited, NetSol, and Arbisoft are increasingly competing in higher-margin segments that demand technical expertise and long-term partnerships.

The startup ecosystem, too, has contributed indirectly by nurturing product-oriented thinking. Even as venture funding has slowed, the know-how and talent cultivated through the startup wave of 2019–2023 are now feeding into export-focused firms.

3. Freelancer Power and Platform Diversification

Pakistan’s freelance economy remains a cornerstone of its IT export performance. The country consistently ranks among the top five freelance markets globally, with tens of thousands of professionals providing services in web development, design, writing, and digital marketing.

However, what’s new is platform diversification. Freelancers are increasingly moving beyond Upwork and Fiverr to direct client acquisition, niche platforms, and LinkedIn-based lead generation. There’s also a growing emphasis on building small agencies rather than operating as solo freelancers — a trend that transforms individual skill into export-scale capacity.

Payment facilitation has also improved slightly, with the State Bank of Pakistan (SBP) working to streamline inward remittances through specialized accounts and improved documentation processes.

4. Regional Expansion and Remote Collaboration

One of the most striking trends in 2025 is the geographic diversification of Pakistan’s IT activity. While Karachi, Lahore, and Islamabad remain dominant, smaller cities — such as Faisalabad, Multan, and Peshawar — are witnessing a quiet but meaningful rise in IT service exports. This expansion is being powered by a mix of remote work infrastructure, co-working spaces, and government-backed training programs.

The widespread adoption of collaboration tools like Slack, Jira, and Notion has made distributed teams more effective. Combined with improving fiber connectivity and affordable hardware, regional developers can now compete in the same global contracts that were once limited to big-city firms.

This decentralization of talent could become one of Pakistan’s long-term competitive advantages — reducing urban congestion while spreading income opportunities.

5. Public Policy, Regulation, and the Push for Formalization

Government policy remains a double-edged sword. On one hand, initiatives such as Special Technology Zones (STZs) and the National IT Export Strategy have provided structure and optimism. On the other hand, inconsistent taxation, slow refund mechanisms, and regulatory red tape continue to frustrate exporters.

The recent establishment of a Ministerial Committee on IT Export Growth and efforts by the Pakistan Software Export Board (PSEB) to streamline registration and reporting processes are positive signs. Formalization — moving freelancers and small firms into the documented economy — is becoming a major policy focus.

If executed well, these reforms could improve data accuracy, enhance investor confidence, and enable more targeted incentives for exporters.

Looking Ahead: From Momentum to Maturity

Pakistan’s IT export growth in 2025 is not an anomaly — it’s the outcome of years of incremental learning, policy trial and error, and global shifts toward remote work. But sustaining this trajectory will depend on how well the country can balance short-term incentives with long-term competitiveness.

To build on current momentum, three strategic priorities stand out:

- Developing advanced skill clusters — especially in AI, cloud infrastructure, and cybersecurity.

- Improving financial flows — ensuring exporters can repatriate and reinvest foreign income easily.

- Strengthening digital infrastructure and branding — positioning Pakistan as a reliable, skilled, and affordable IT partner globally.

If these pillars hold, Pakistan could realistically aim for $5–6 billion in annual IT exports within the next three years — a target that once seemed ambitious, but now feels attainable.

Sources: Pakistan Today, Business Recorder, PSEB, SBP, IT industry analysis, and interviews with IT professionals.

Leave a Reply